Buying In The Fall Market

The Fall market presents all new opportunities for buyers who didn’t score a house earlier in the year. But how do you find them? Here

The Fall market presents all new opportunities for buyers who didn’t score a house earlier in the year. But how do you find them? Here

It may be a Seller’s market, but many Sellers haven’t sold a home in years – if EVER – and have no idea what will

You’re buying a home and are wondering if there’s a ghost in the attic. Does the seller need to disclose it? If you are buying

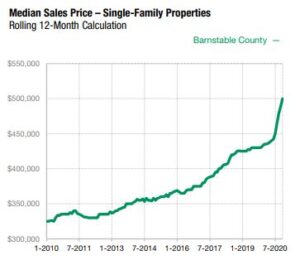

It’s been exactly one year since buyers started entering the Cape Cod market with wild abandon – sending prices soaring with each passing week and

The first quarter of 2021 is just about over and the Cape Cod real estate market has continued to frustrate buyers, thrill sellers, and leave

It was the best of times; it was the worst of times! True of late 18th century London and Paris and true of the 2020

When you have specialized questions about buying real estate, sometimes the best answer your Realtor can give you is the name or website of the

Well, not literally, but anyone who has been watching the real estate market on the Cape knows that it is hot to the touch! Painfully

Buyers, sellers, and homeowners alike have been asking us repeatedly how the Cape Cod real estate market is faring in light of the coronavirus pandemic.