2020: The Year In Review

It was the best of times; it was the worst of times! True of late 18th century London and Paris and true of the 2020

It was the best of times; it was the worst of times! True of late 18th century London and Paris and true of the 2020

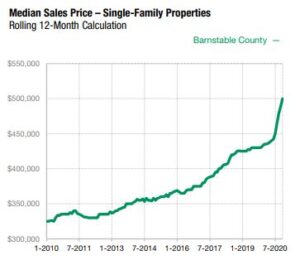

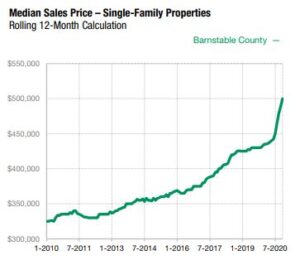

Buyers, sellers, and homeowners alike have been asking us repeatedly how the Cape Cod real estate market is faring in light of the coronavirus pandemic.

When a home is sold in Massachusetts, it is Massachusetts law that the smoke detectors be compliant with current smoke & carbon monoxide detector laws.

More and more, vacation rental tenants are encountering properties with security cameras installed, which causes concerns about violation of privacy. Is it legal for homeowners

With 550 miles of coastline, Cape Cod is arguably New England’s premier summer vacation destination. If you’re lucky enough to own a home here, especially

When searching the Cape & Islands MLS, you’ll frequently encounter references to something known in Massachusetts as “Title V”, a state regulation pertaining to septic

Many Cape Cod home buyers haven’t bought a home in a very long time and possibly NEVER in Massachusetts. Others may be first-time home buyers

The newsletter goofed! Click the link below for the blog article on the Home Buying Process. Review of the Home Buying Process Cape Cod

You’ve probably heard that FEMA has revised its flood maps nationwide and that many Cape Cod homeowners may now require expensive flood insurance policies, even